AZAdvances has become in Investor in the newly launched Life Sciences Workforce Collaborative.

As conduits to large networks of industry, academic and other allied stakeholders, the LSWC is ideally poised to facilitate workforce solutions for the industry amidst a constantly shifting workforce landscape impacted by: cycles of growth and retraction; competition for talent; outsized demand for skilled technicians; and the continued need by the industry to access, advance, and retain a broad talent base.

Together, we are a growing body of workforce partnerships and best practices, creating opportunities to build strong engagement and impact across the United States and Puerto Rico.

2025 Life Sciences Workforce Trends

Now in its 7th edition, the biennial national workforce trends report is recognized across the life science industry for its “real-time” data analysis derived from executive interviews, hiring surveys, and job postings from across the country and Puerto Rico.

LSWC led the development of the report.

Produced since 2013 – and since 2023, with TEConomy Partners, LLC and InnovATEBIO, the NSF-supported National Biotech Education Center – the report has captured the most pressing talent needs of the life sciences industry through periods of accelerated growth & retraction, competition for talent, disruptive technologies, reshored manufacturing, COVID and post-COVID dynamics, and more.

Helping to shape the national discourse on workforce solutions for the life sciences industry, the report is broadly distributed through LSWC industry, academic and governmental networks, and past editions have been featured in BioSpace, Nature, and other workforce-related forums.

Download the Report | Download the Key Findings

AZAdvances underwrites the creation of the Arizona-specific data set.

AZAdvances funding supported the creation of a state-specific supplement to the national LSWC/TEConomy Life Sciences Workforce Trends report that presents summary information on industry job postings for Arizona.

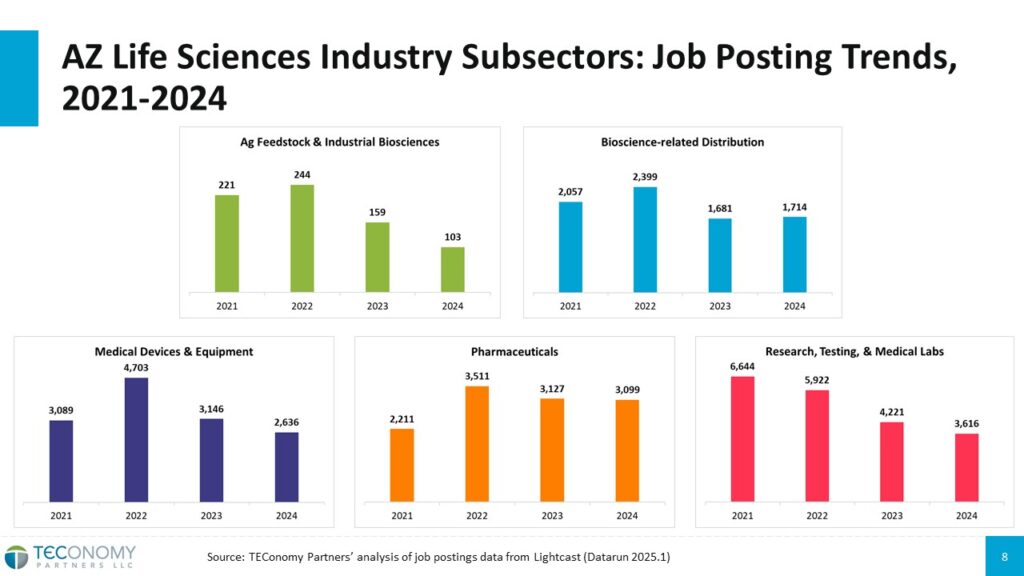

The data represent the latest four years of unique (non-duplicative) job postings across the life sciences industry and its five major subsectors—agricultural feedstock and industrial biosciences; bioscience-related distribution; medical devices and equipment; pharmaceuticals; and research, testing, and medical laboratories.

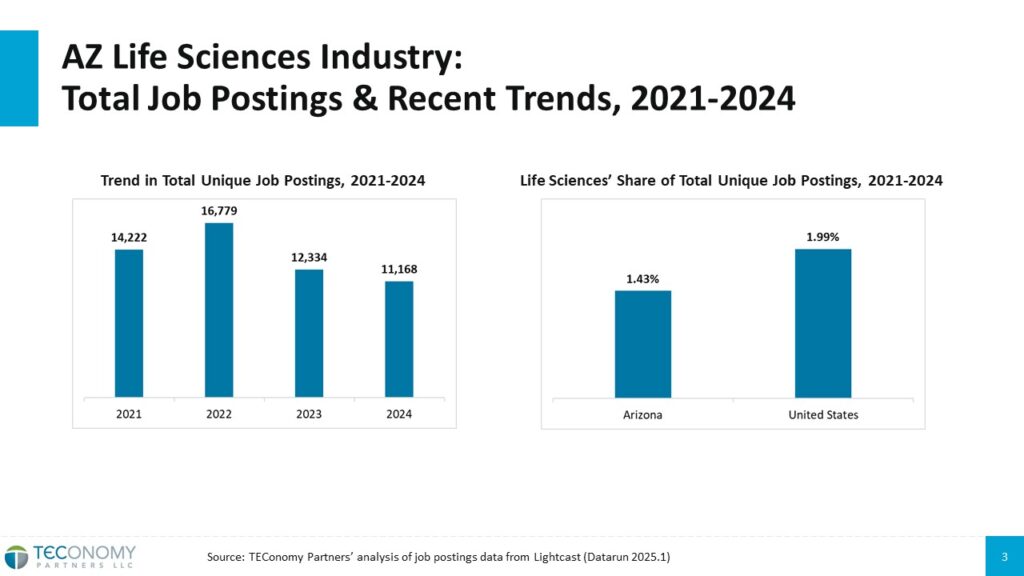

From January 2021 through December 2024, Arizona life sciences companies posted a total of 54,503 unique job opportunities.

The COVID-19 Pandemic and the Recovery drove demand for health innovation workforce in 2021/2022. As things began to stabilize, job postings declined.

Here is how the job posting trends track by industry subsector.

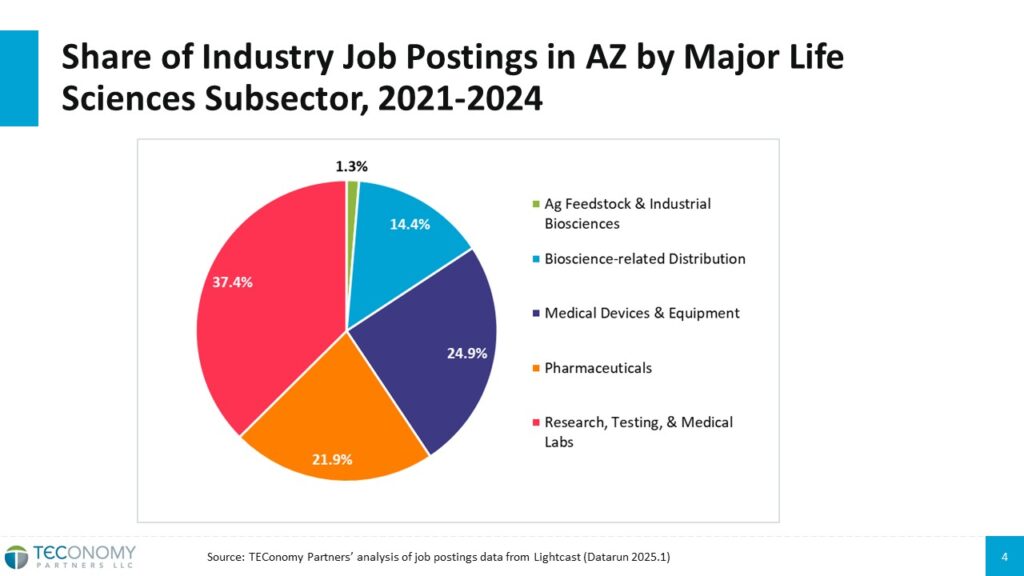

The percentage share of job postings by industry subsector reflects Arizona’s diverse health innovation ecosystem

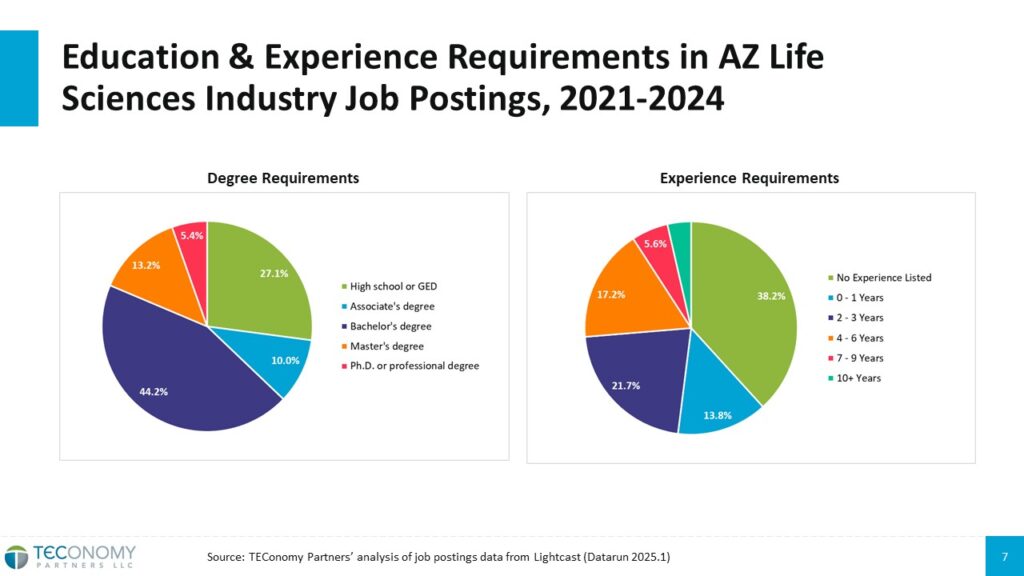

The data shows that over 37% of job postings are open to people with High School, GED, or Associate Degrees. While levels of experience vary across positions.

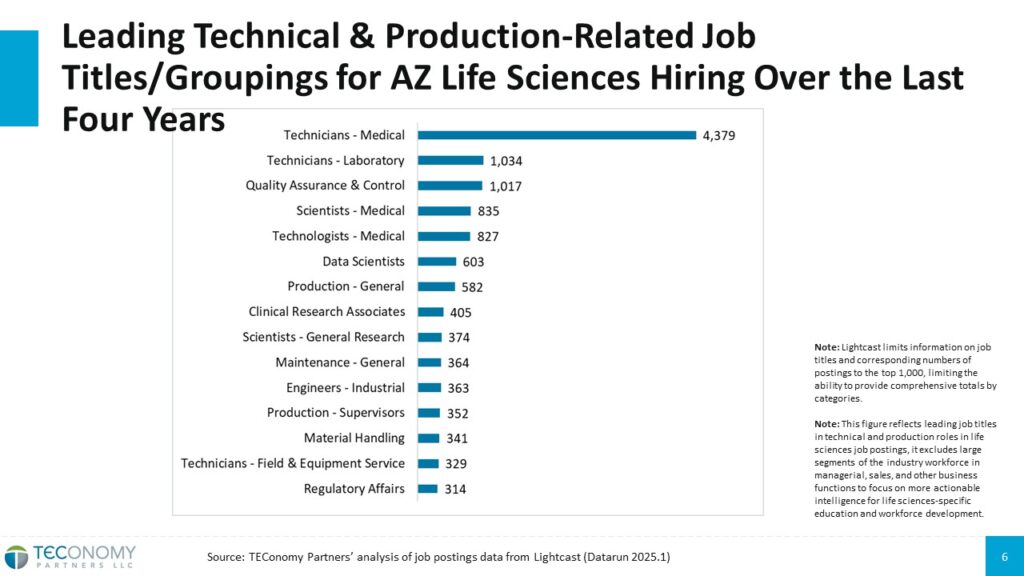

The high demand for medical and laboratory positions tracks with opportunities for people who are entering the workplace without 4-year or advanced degrees and create an open entry point for future career growth.

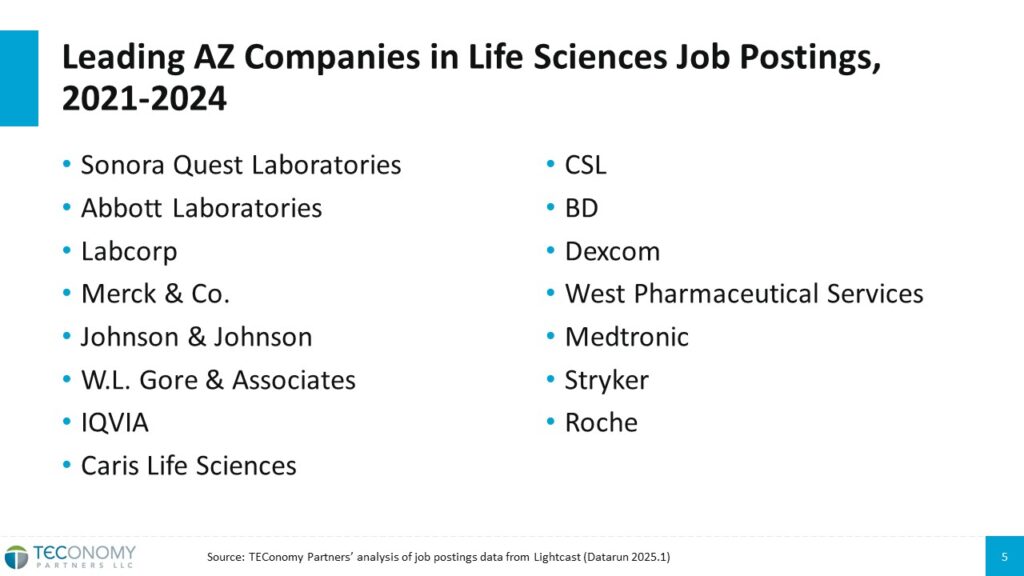

Arizona’s most active talent recruiters span the continuum from laboratory services to manufacturing and from development to product delivery.