Frequently Asked Questions

The mission of AZAdvances ™ is to support the creation and commercialization of Arizona-based health innovations.

AZAdvances is a division of the Opportunity Through Entrepreneurship Foundation (OTEF) a 501c3 non profit and grass roots organization that provides entrepreneurial education, mentoring and support to individuals and organizations. For additional documentation, print OTEF’s gift letter or print the IRS Determination Letter.

The mission of the Opportunity Through Entrepreneurship Foundation (OTEF) is to provide a path to for economic sustainability to at-risk populations that are often forgotten or left behind and to support entrepreneurs and innovators to deliver products and services which improve the world around us.

Early stage investors have many options for their investment dollars. Life science opportunities, especially those that are early in the development cycle, can appear daunting at best. AZAdvances’ endowment based model allows companies to access the capital needed to move further along the development cycle and begin to mitigate early development risk. As the level of risk declines, the companies become more attractive to traditional sources of capital including angel investment, venture capital, and other forms of equity investment.

There is always a risk that promising young firms will be drawn away or forced to move in their quest for investment dollars. Past experience has shown that the best way to keep companies in place is to root them in the community. Companies can be rooted by investments in facilities, strategic partnerships with universities or clinical partners, or by key local talent. Past examples of well rooted companies that were acquired, stayed, and continue to grow here include Ventana (Roche), Abraxis (BMS), Ulthera (Merz), CBR (Generate Life Sciences) and MicroRel (Medtronic).

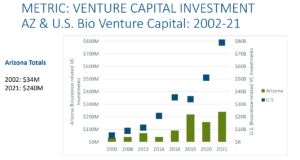

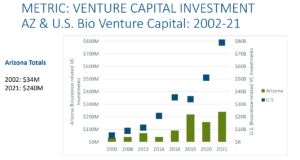

National data supports that when a state has institutional investment focused on the life science sector based in that state, levels of life science venture investment were significantly higher. The most notable examples are California and Massachusetts, but it does not stop there. States including Colorado, Missouri, North Carolina, and Utah have made significant gains by focusing and investing in the life science sector.

AZAdvances’ investments into Arizona life science companies, at the direction of the AZAdvances trustees, can serve as a first institutional investor for local companies and provide syndication support to additional local and out of state investment partners.

AZAdvances’ endowment model also provides for a steady stream of investment capital inside the state so that the peaks and valleys of traditional venture fund structures can be avoided. In addition, through AZAdvances’ support of the incubators and accelerators within Arizona’s life science innovation ecosystem, entrepreneurs are better supported and more likely to succeed.

Image Source: Source: TEConomy Partners for the Flinn Foundation Arizona Bioscience Roadmap Update (2022)

AZAdvances activities are divided into two areas, programs that strengthen the life science ecosystem and mission related investments into early stage life science companies. Funding is proposed based on funds available and subject to approval by the AZAdvances Trustees and the OTEF Board of Directors.

Program Examples

- Supporting Incubator & Accelerator activities

- Matching grants for feasibility studies or proof-of-concept grants to non-profit research institutes

- Hosting Investor Events

- Acquiring Shared Resources & Equipment

- Licensing Shared Information Databases

- Programs that support developing tomorrow’s talent

- Grant focused activities consistent with our mission

Mission Related Investments

- SBIR Matching Investments

- Angel Investment Matching

- Direct or Co-investment

Investments may take the form of Convertible Notes for seed investments or Equity based investments as determined by the AZAdvances Trustees on a case by case basis following the due diligence process.

Maintained as separate accounts within the Opportunity Through Entrepreneurship Foundation (OTEF), a 501c3 public charity established in 2005, AZAdvances is structured to make an impact today and for generations to come.

AZAdvances is designed to address our early stage life science funding challenge in a way that is both strategic and sustainable. Combining the immediate impact of a current use fund with a separate evergreen endowment, the AZAdvances structure, once capitalized, can provide a steady stream of early stage capital to move Arizona-based health innovations forward.

- The AZAdvances Today Fund is a current use fund designed to accept donations and distributions from the AZAdvances Legacy Endowment and the Arizona Health Innovation Trust Fund. The AZAdvances Today Fund will fund AZAdvances programs, distribute grants and mission related investments based on the needs of the life science ecosystem and the projects that have the greatest potential for future impact in accordance with our mission and as directed by the AZAdvances Board of Trustees.

- The AZAdvances Legacy Endowment is a long-term, evergreen endowment designed to grow the core capital and make annual distributions into the AZAdvances Today Fund.

- Special Purpose Funds may be established based on donor request for express purposes that are consistent with our mission.

AZAdvances Trustees will evaluate applications to determine which programs and projects can deliver the greatest impact based on funds available.

The equity generated from AZAdvances mission related investments is held within the AZAdvances Legacy Endowment. By reinvesting future returns from AZAdvances’ early stage investments, AZAdvances will grow the base endowment so that the distributions can grow as the endowment grows. To maintain an appropriately diversified investment portfolio, the core capital of the AZAdvances Legacy Endowment will be invested in a growth-oriented, diversified portfolio of public and private investments.

Through OTEF, AZAdvances will allocate funds to the approved projects out of the AZAdvances Today Fund. In the case of grants, the AZAdvances trustees will administer and track performance. In the case of early stage investments, they will become part of the holdings of the AZAdvances Legacy Endowment. As these investments mature and exit, they will help to build the value of the core capital so that AZAdvances has greater capacity to support the community in the future.

Banking and Investments

The Opportunity Through Entrepreneurship Foundation (OTEF) currently maintains its accounts at Chase Bank, N.A. As AZAdvances accounts grow, the OTEF Board of Directors and the AZAdvances Trustees will determine what additional fiduciary services are required to manage the core capital, equity holdings, and distributions.

The State of Arizona established the Arizona Health Innovation Trust Fund in 2022. The fund is designed to accept public and private monies that will grow over time under management by the Arizona State Treasurer’s Office (ASTO). The Opportunity Through Entrepreneurship Foundation entered into an endowment agreement ASTO and will receive the annual distributions supporting the AZAdvances initiative beginning in 2027. Annual distributions will be deposited into the AZAdvances Today Fund.

This structure provides donors with assurance that endowed funds will be appropriately managed in perpetuity. In addition, management by ASTO provides greater access to high quality investment opportunities to drive growth of the core capital of the endowment. Distributions from the fund are public funds and also help to support maintaining OTEF’s public charity status.

OTEF’s endowment agreement with the ASTO requires an annual report be submitted to the Governor, the President of the Senate, the Speaker of the House of Representatives and the State Treasurer and the Secretary of State.

To view the statutory language, click here. Copies of Annual Reports and OTEF’s 990 report to the IRS are available upon request.

The Opportunity Through Entrepreneurship Foundation was incorporated in the State of Arizona in 2005 and is organized under Arizona Law. The Opportunity Through Entrepreneurship Foundation was granted IRS Section 501c3 public charity status effective November 2, 2005. EIN# 20-3779020

Please consult your tax advisor with questions about how your donation applies to your personal tax situation.

Giving appreciated securities (publicly traded or closely held), bonds, or mutual fund shares is an option. A gift of appreciated securities may qualify for a charitable tax deduction and may avoid the long-term capital gains tax on the appreciated value of the asset. Stocks or bonds held more than one year that have increased in value may qualify for a deduction equal to the full market value of the gift. With stocks or bonds worth less than the price you paid for them, the wisest course is to sell them and give the cash proceeds. The sale will establish a loss that may offset other capital gains income.

To discuss a non-cash donation, please contact us.

Please consult your tax advisor with questions about the deductibility of these gifts and how it applies to your personal tax situation.

As a cryptocurrency investor, you understand the power of innovation. By donating cryptocurrency, you can make an important difference in the race to develop the treatments and cures that people are waiting for.

OTEF has partnered with The Giving Block as its crypto donation processor. Cryptocurrency donations are converted to USD donations by The Govvong Block and deposited into OTEF’s accounts. A widget on our donor page make this process easy for crypto philanthropists.

The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501(c)3 charities like OTEF receive the same tax treatment as stocks. Donating cryptocurrency is a non-taxable event, meaning you do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. Please contact your tax or financial advisor for more information.

There are many ways that members of our community can get involved in helping AZAdvances achieve the goal of building a $200 Million Endowment within the AZAdvances Legacy Endowment and the $50 Million AZAdvances Today Fund.

In-kind Professional Services

- Marketing and Communications Support

- Legal Services (IP and General Business)

- Business Advisory

- Market Research

Individual Volunteers

- Social Media Outreach

- Community Outreach & Introductions

- Database support

- Hosting Events

For specific ideas on how you can get involved, contact us.

When a donor commits their resources to a non-profit organization, we believe that they should have access to information about our organization, including our current plans, the metrics we set, the outcomes we achieve, and more. That is why we will continuously maintain our most up to date information on GuideStar.

The AZAdvances Board of Trustees are comprised of Arizona Leaders as well as at least one Trustee serving on the OTEF board of directors as board liaison. Please see our Team page for more information.

All decisions on grants and investments made by AZAdvances will be directed by the AZAdvances Board of Trustees based on what they believe will have the greatest potential for impact each year. Each year the the AZAdvances Trustees will determine the mix of available grant and investment dollars that will have the greatest potential impact. It will be up to the then-current AZAdvances Trustees to establish or adjust its grant making policies or allocations in accordance with AZAdvances’ mission. AZAdvances mission is specific to Arizona. At no time will the AZAdvances Trustees approve allocations for projects that are outside of Arizona or that do not specifically impact Arizona-based operations.

Grants

AZAdvances Trustees may approve direct-expenditure grants to non-profit organizations consistent with the our mission, the needs of local ecosystem and the terms of applicable grant agreements. Grants will be paid by OTEF as recommended by the AZAdvances Trustees and approved by the OTEF Board of Directors.

Mission Related Investments

AZAdvances Trustees may recommend investments into for-profit companies from its annual distribution that are consistent with its mission and the then-current investment criteria approved by the AZAdvances Trustees and the AZAdvances Investment Committee. Investments will be made by OTEF and managed within the AZAdvances separate account at OTEF.

Due diligence is an essential component of any investment strategy and can be even more complex in the life science sector. In addition to internal due diligence resources. AZAdvances will leverage its relationships with national Venture Capital firms, Arizona’s Angel Groups, Life Science Incubators and Accelerators, Universities, Private Research Institutes and Hospital systems for additional insights

The Directors of the Opportunity Through Entrepreneurship Foundation are:

- Joan Koerber-Walker, MBA currently serves as Chairman of the Opportunity Through Entrepreneurship Foundation (OTEF) and President & CEO, Arizona Bioindustry Association (AZBio). Joan’s career includes past roles as CEO of the Arizona Small Business Association; as Treasurer and Board Member for RiboMed Biotechnologies, Inc.; and as an executive at Avnet, Inc, where, for over a 20 year span, she held a wide variety of roles in sales, marketing, technology, supply chain management, and global administration. She has served in the non profit community for over two decades including as a member of the Board of Trustees of the National Small Business Association in Washington D.C.; Chair of the Board of Advisors to CPLC Parenting Arizona, a child abuse prevention agency that provides family support services across Arizona; and as a member of the Executive Committee of the Industry Advisory Board for the Thomas and Joan Read Center at Texas A&M University. Joan was awarded a BA in Economics from the University of Delaware, an MBA from the W.P. Carey School of Business at Arizona State University, and is a member of Beta Gamma Sigma.

- Rob Dunaway, Esq. currently serves as a Director and Secretary of the Opportunity Through Entrepreneurship Foundation (OTEF). Dunaway is one of the most experienced business attorneys in Arizona, and over the past several decades has helped thousands of companies of all sizes to succeed. From his start in the Silicon Valley, counseling technology companies like Sun Microsystems and Tandem Computers, to his 17 years in Arizona guiding hundreds of startup ventures – including over 50 merger & acquisition transactions and over 400 private investor fundings. Dunaway’s Phoenix business law practice specializes in helping companies of all types build a solid foundation and grow into a thriving business. Dunaway’s expertise is focused on general corporate, contract and intellectual property law, with an emphasis on corporate and LLC formation, technology licensing and other technology-related contracts such as consulting, OEM, distribution and development agreements; venture capital and other private investor financings; mergers and acquisitions; protection of intellectual property; and internet law.

- Ed Nusbaum currently serves as a Director of the Opportunity Through Entrepreneurship Foundation (OTEF). Nusbaum is a cofounder and partner of Stealthmode Partners. Since 2008, he has served on the board of The NROC Project [nroc.org] formerly the Monterey Institute for Technology and Education. NROC is a non-profit organization committed to improving access to education. Previously, Ed has served as a board member of the Arizona Technology Council, Arizona Internet Professionals Association, AeA, and TiE-Arizona. (EdNusbaum.com)

- Francine Hardaway, PhD currently serves as Executive Director and is a non-voting member of the OTEF Board. Dr. Hardaway is the co-founder of Stealthmode Partners, an accelerator and advocate for entrepreneurs in technology and health care that was founded in 1998. Prior to Stealthmode, she owned two marketing companies, and served as Director of Worldwide Press Relations for Intel and the CMO of Innovative Environmental Products. Her communications specialties are technology, healthcare and financial services. She was an Entrepreneurial Fellow of the Eller Entrepreneurship Center at University of Arizona, and was a founder of Social Media Club Arizona and the Arizona Software Association. She is co-founder of the blog USHealthCrisis, and blogs for Fast Company, Huffington Post, and Stealthmode’s blog

The mission of AZAdvances ™ is to support the creation and commercialization of Arizona-based health innovations.

AZAdvances is a division of the Opportunity Through Entrepreneurship Foundation (OTEF) a 501c3 non profit and grass roots organization that provides entrepreneurial education, mentoring and support to individuals and organizations. For additional documentation, print OTEF’s gift letter or print the IRS Determination Letter.

The mission of the Opportunity Through Entrepreneurship Foundation (OTEF) is to provide a path to for economic sustainability to at-risk populations that are often forgotten or left behind and to support entrepreneurs and innovators to deliver products and services which improve the world around us.

Early stage investors have many options for their investment dollars. Life science opportunities, especially those that are early in the development cycle, can appear daunting at best. AZAdvances’ endowment based model allows companies to access the capital needed to move further along the development cycle and begin to mitigate early development risk. As the level of risk declines, the companies become more attractive to traditional sources of capital including angel investment, venture capital, and other forms of equity investment.

There is always a risk that promising young firms will be drawn away or forced to move in their quest for investment dollars. Past experience has shown that the best way to keep companies in place is to root them in the community. Companies can be rooted by investments in facilities, strategic partnerships with universities or clinical partners, or by key local talent. Past examples of well rooted companies that were acquired, stayed, and continue to grow here include Ventana (Roche), Abraxis (BMS), Ulthera (Merz), CBR (Generate Life Sciences) and MicroRel (Medtronic).

National data supports that when a state has institutional investment focused on the life science sector based in that state, levels of life science venture investment were significantly higher. The most notable examples are California and Massachusetts, but it does not stop there. States including Colorado, Missouri, North Carolina, and Utah have made significant gains by focusing and investing in the life science sector.

AZAdvances’ investments into Arizona life science companies, at the direction of the AZAdvances trustees, can serve as a first institutional investor for local companies and provide syndication support to additional local and out of state investment partners.

AZAdvances’ endowment model also provides for a steady stream of investment capital inside the state so that the peaks and valleys of traditional venture fund structures can be avoided. In addition, through AZAdvances’ support of the incubators and accelerators within Arizona’s life science innovation ecosystem, entrepreneurs are better supported and more likely to succeed.

Image Source: Source: TEConomy Partners for the Flinn Foundation Arizona Bioscience Roadmap Update (2022)

AZAdvances activities are divided into two areas, programs that strengthen the life science ecosystem and mission related investments into early stage life science companies. Funding is proposed based on funds available and subject to approval by the AZAdvances Trustees and the OTEF Board of Directors.

Program Examples

- Supporting Incubator & Accelerator activities

- Matching grants for feasibility studies or proof-of-concept grants to non-profit research institutes

- Hosting Investor Events

- Acquiring Shared Resources & Equipment

- Licensing Shared Information Databases

- Programs that support developing tomorrow’s talent

- Grant focused activities consistent with our mission

Mission Related Investments

- SBIR Matching Investments

- Angel Investment Matching

- Direct or Co-investment

Investments may take the form of Convertible Notes for seed investments or Equity based investments as determined by the AZAdvances Trustees on a case by case basis following the due diligence process.

Maintained as separate accounts within the Opportunity Through Entrepreneurship Foundation (OTEF), a 501c3 public charity established in 2005, AZAdvances is structured to make an impact today and for generations to come.

AZAdvances is designed to address our early stage life science funding challenge in a way that is both strategic and sustainable. Combining the immediate impact of a current use fund with a separate evergreen endowment, the AZAdvances structure, once capitalized, can provide a steady stream of early stage capital to move Arizona-based health innovations forward.

- The AZAdvances Today Fund is a current use fund designed to accept donations and distributions from the AZAdvances Legacy Endowment and the Arizona Health Innovation Trust Fund. The AZAdvances Today Fund will fund AZAdvances programs, distribute grants and mission related investments based on the needs of the life science ecosystem and the projects that have the greatest potential for future impact in accordance with our mission and as directed by the AZAdvances Board of Trustees.

- The AZAdvances Legacy Fund is a long-term, evergreen endowment designed to grow the core capital and make annual distributions into the AZAdvances Today Fund.

- Special Purpose Funds may be established based on donor request for express purposes that are consistent with our mission.

AZAdvances Trustees will evaluate applications to determine which programs and projects can deliver the greatest impact based on funds available.

The equity generated from AZAdvances mission related investments is held within the AZAdvances Legacy Endowment. By reinvesting future returns from AZAdvances’ early stage investments, AZAdvances will grow the base endowment so that the distributions can grow as the endowment grows. To maintain an appropriately diversified investment portfolio, the core capital of the AZAdvances Legacy Endowment will be invested in a growth-oriented, diversified portfolio of public and private investments.

Through OTEF, AZAdvances will allocate funds to the approved projects out of the AZAdvances Today Fund. In the case of grants, the AZAdvances trustees will administer and track performance. In the case of early stage investments, they will become part of the holdings of the AZAdvances Legacy Endowment. As these investments mature and exit, they will help to build the value of the core capital so that AZAdvances has greater capacity to support the community in the future.

Banking and Investments

The Opportunity Through Entrepreneurship Foundation (OTEF) currently maintains its accounts at Chase Bank, N.A. As AZAdvances accounts grow, the OTEF Board of Directors and the AZAdvances Trustees will determine what additional fiduciary services are required to manage the core capital, equity holdings, and distributions.

In the 2022 legislative session, HB2863 established the Arizona Health Innovation Trust Fund with an effective date of September 24, 2022. The State of Arizona seeded the Trust Fund with an initial deposit of $100,000.00 to establish the fund.

The fund is designed to accept public and private monies that will grow over time. It is anticipated that the Opportunity Through Entrepreneurship Foundation will enter into an endowment agreement with the Arizona State Treasurer’s Office and will receive the annual distributions to support the AZAdvances initiative. Annual Distributions will be deposited in the AZAdvances Today Fund. This structure provides donors with assurance that endowed funds will be appropriately managed in perpetuity.

Arizona Health Innovation Trust Fund (Trust Fund)

The Trust Fund to be administered by the State Treasurer as a trustee and is a permanent endowment fund consisting of monies appropriated by the Legislature, earnings from the Trust Fund and gifts or grants donated or given to the Trust Fund. These monies are continuously appropriated and exempt from lapsing. The State Treasurer will accept, separately account for and hold in trust any Trust Fund monies deposited in the State Treasury and will not comingle the Trust Fund monies with other monies in the State Treasury except for investment purposes. HB2863 mandates the State Treasurer to invest and divest any Trust Fund monies deposited in the State Treasury and requires monies earned from interest and investment income to be credited to the Trust Fund. The fund deposits have a 5 year maturity rate and distributions are based on a 5 year average.

HB2863 instructs the State Treasurer to annually allocate 4% of the monies in the Trust Fund to an entity that:

- Is a qualified and charitable organization under 501(c)(3) of the U.S. Internal Revenue Code for federal income tax purposes;

- Provides entrepreneurial education, support and mentoring to persons in the health innovation and health care delivery sectors in Arizona;

- Provides workforce development programs that supports the talent requirements of employers in the health innovation and health sectors in Arizona;

- Provides programs supporting the development and commercialization of health innovation by Arizona based businesses that employ no more than 100 employees; and

- Has entered into an endowment agreement with the State Treasurer including investment procedures, maturity timelines and other requirements including how distributions from the Trust Fund are used and the social and economic impact of the use.

Requires, annually on December 31, the entity to submit a report prescribed by the Treasurer to the Governor, the President of the Senate, the Speaker of the House of Representatives and the State Treasurer and to submit a copy of the report to the Secretary of State.

To view the statutory language, click here.

The Opportunity Through Entrepreneurship Foundation was incorporated in the State of Arizona in 2005 and is organized under Arizona Law. The Opportunity Through Entrepreneurship Foundation was granted IRS Section 501c3 public charity status effective November 2, 2005. EIN# 20-3779020

Please consult your tax advisor with questions about how your donation applies to your personal tax situation.

Giving appreciated securities (publicly traded or closely held), bonds, or mutual fund shares is an option. A gift of appreciated securities may qualify for a charitable tax deduction and may avoid the long-term capital gains tax on the appreciated value of the asset. Stocks or bonds held more than one year that have increased in value may qualify for a deduction equal to the full market value of the gift. With stocks or bonds worth less than the price you paid for them, the wisest course is to sell them and give the cash proceeds. The sale will establish a loss that may offset other capital gains income.

To discuss a non-cash donation, please contact us.

Please consult your tax advisor with questions about the deductibility of these gifts and how it applies to your personal tax situation.

As a cryptocurrency investor, you understand the power of innovation. By donating cryptocurrency, you can make an important difference in the race to develop the treatments and cures that people are waiting for.

OTEF has partnered with The Giving Block as its crypto donation processor. Cryptocurrency donations are converted to USD donations by The Govvong Block and deposited into OTEF’s accounts. A widget on our donor page make this process easy for crypto philanthropists.

The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501(c)3 charities like OTEF receive the same tax treatment as stocks. Donating cryptocurrency is a non-taxable event, meaning you do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. Please contact your tax or financial advisor for more information.

There are many ways that members of our community can get involved in helping AZAdvances achieve the goal of building a $200 Million Endowment within the AZAdvances Legacy Endowment and the $50 Million AZAdvances Today Fund.

In-kind Professional Services

- Marketing and Communications Support

- Legal Services (IP and General Business)

- Business Advisory

- Market Research

Individual Volunteers

- Social Media Outreach

- Community Outreach & Introductions

- Database support

- Hosting Events

For specific ideas on how you can get involved, contact us.

When a donor commits their resources to a non-profit organization, we believe that they should have access to information about our organization, including our current plans, the metrics we set, the outcomes we achieve, and more. That is why we will continuously maintain our most up to date information on GuideStar.

The AZAdvances Board of Trustees are comprised of Arizona Leaders as well as at least one Trustee serving on the OTEF board of directors as board liaison. Please see our Team page for more information.

All decisions on grants and investments made by AZAdvances will be directed by the AZAdvances Board of Trustees based on what they believe will have the greatest potential for impact each year. Each year the the AZAdvances Trustees will determine the mix of available grant and investment dollars that will have the greatest potential impact. It will be up to the then-current AZAdvances Trustees to establish or adjust its grant making policies or allocations in accordance with AZAdvances’ mission. AZAdvances mission is specific to Arizona. At no time will the AZAdvances Trustees approve allocations for projects that are outside of Arizona or that do not specifically impact Arizona-based operations.

Grants

AZAdvances Trustees may approve direct-expenditure grants to non-profit organizations consistent with the our mission, the needs of local ecosystem and the terms of applicable grant agreements. Grants will be paid by OTEF as recommended by the AZAdvances Trustees and approved by the OTEF Board of Directors.

Mission Related Investments

AZAdvances Trustees may recommend investments into for-profit companies from its annual distribution that are consistent with its mission and the then-current investment criteria approved by the AZAdvances Trustees and the AZAdvances Investment Committee. Investments will be made by OTEF and managed within the AZAdvances separate account at OTEF.

Due diligence is an essential component of any investment strategy and can be even more complex in the life science sector. In addition to internal due diligence resources. AZAdvances will leverage its relationships with national Venture Capital firms, Arizona’s Angel Groups, Life Science Incubators and Accelerators, Universities, Private Research Institutes and Hospital systems for additional insights

The Directors of the Opportunity Through Entrepreneurship Foundation are:

- Joan Koerber-Walker, MBA currently serves as Chairman of the Opportunity Through Entrepreneurship Foundation (OTEF) and President & CEO, Arizona Bioindustry Association (AZBio). Joan’s career includes past roles as CEO of the Arizona Small Business Association; as Treasurer and Board Member for RiboMed Biotechnologies, Inc.; and as an executive at Avnet, Inc, where, for over a 20 year span, she held a wide variety of roles in sales, marketing, technology, supply chain management, and global administration. She has served in the non profit community for over two decades including as a member of the Board of Trustees of the National Small Business Association in Washington D.C.; Chair of the Board of Advisors to CPLC Parenting Arizona, a child abuse prevention agency that provides family support services across Arizona; and as a member of the Executive Committee of the Industry Advisory Board for the Thomas and Joan Read Center at Texas A&M University. Joan was awarded a BA in Economics from the University of Delaware, an MBA from the W.P. Carey School of Business at Arizona State University, and is a member of Beta Gamma Sigma.

- Rob Dunaway, Esq. currently serves as a Director and Secretary of the Opportunity Through Entrepreneurship Foundation (OTEF). Dunaway is one of the most experienced business attorneys in Arizona, and over the past several decades has helped thousands of companies of all sizes to succeed. From his start in the Silicon Valley, counseling technology companies like Sun Microsystems and Tandem Computers, to his 17 years in Arizona guiding hundreds of startup ventures – including over 50 merger & acquisition transactions and over 400 private investor fundings. Dunaway’s Phoenix business law practice specializes in helping companies of all types build a solid foundation and grow into a thriving business. Dunaway’s expertise is focused on general corporate, contract and intellectual property law, with an emphasis on corporate and LLC formation, technology licensing and other technology-related contracts such as consulting, OEM, distribution and development agreements; venture capital and other private investor financings; mergers and acquisitions; protection of intellectual property; and internet law.

- Ed Nusbaum currently serves as a Director of the Opportunity Through Entrepreneurship Foundation (OTEF). Nusbaum is a cofounder and partner of Stealthmode Partners. Since 2008, he has served on the board of The NROC Project [nroc.org] formerly the Monterey Institute for Technology and Education. NROC is a non-profit organization committed to improving access to education. Previously, Ed has served as a board member of the Arizona Technology Council, Arizona Internet Professionals Association, AeA, and TiE-Arizona. (EdNusbaum.com)

- Francine Hardaway, PhD currently serves as Executive Director and is a non-voting member of the OTEF Board. Dr. Hardaway is the co-founder of Stealthmode Partners, an accelerator and advocate for entrepreneurs in technology and health care that was founded in 1998. Prior to Stealthmode, she owned two marketing companies, and served as Director of Worldwide Press Relations for Intel and the CMO of Innovative Environmental Products. Her communications specialties are technology, healthcare and financial services. She was an Entrepreneurial Fellow of the Eller Entrepreneurship Center at University of Arizona, and was a founder of Social Media Club Arizona and the Arizona Software Association. She is co-founder of the blog USHealthCrisis, and blogs for Fast Company, Huffington Post, and Stealthmode’s blog